Guide to Audit Compliance Report for Retail Store with FREE Template

An audit compliance report is a must for any retail store to maintain operational transparency and compliance today, when the retail environment is turning competitive and becoming highly regulated. An audit compliance report plays a vital role in helping retail stores not only meet legal standards but also improve performance and profitability. According to a report by Deloitte, businesses with strong compliance and audit systems experience up to 30% fewer operational disruptions and 25% higher efficiency in store operations.

For retail chains, especially those operating across multiple locations, consistent audits help track store-level execution, ensure brand consistency, and reduce risks related to inventory mismanagement or non-compliance with local laws. Moreover, audit reports support data-driven decisions, enhance accountability, and build trust with regulators and stakeholders.

This guide walks you through the essentials of preparing and leveraging an audit compliance report for your retail store, covering core components, compliance requirements, tools like Taqtics, and common challenges, ensuring your store operates legally, efficiently, and sustainably.

What is an Audit Compliance Report?

An audit compliance report is a formal document that details an organization’s compliance with statutory laws, regulations, and internal policies as verified during an audit. The audit compliance report is crucial for ensuring transparency, accountability, and adherence to frameworks such as the Companies Act, 2013, Income Tax Act, GST laws, SEBI regulations, and sector-specific guidelines.

The report summarizes the scope of the audit, observations, instances of non-compliance, corrective measures taken, and recommendations for aligning with legal and regulatory requirements. It helps regulators, stakeholders, and management understand the organization’s compliance posture and supports informed decision-making. Audit compliance reporting is critical in industries like finance, healthcare, and IT, where strict regulations (e.g., SOX, HIPAA, GDPR) must be followed. These reports help organizations maintain transparency, mitigate risks, and ensure accountability.

For example, company X undergoes a statutory audit under the Companies Act. The audit compliance report reveals delayed GST filings and incomplete board meeting records. These issues are documented, and the report includes steps taken to rectify them, such as timely future filings and improved documentation practices. It is then submitted to the board and, if required, disclosed to regulatory bodies like SEBI.

In India, such reports are essential for corporate governance and can influence investor confidence, regulatory standing, and risk management. They ensure that organizations operate within the legal framework and continuously improve their compliance systems.

Who is Responsible for Audit Compliance Reporting?

An organization’s management, with oversight from the board of directors and audit committee, is responsible for audit compliance reporting. The management is accountable for establishing internal controls, ensuring compliance with applicable laws, and providing accurate records during audits. The internal audit team or appointed external auditors conduct the audit and prepare the compliance report based on their findings.

In regulated sectors or public companies, the Chief Compliance Officer (CCO) or Chief Financial Officer (CFO) play a key role in coordinating audit activities and ensuring timely and accurate reporting. The audit committee ensures the independence of the audit process and reviews the final report before it is submitted to regulators or stakeholders.

Ultimately, while auditors prepare the report, the organization’s leadership is responsible for addressing issues, implementing corrective actions, and maintaining continuous compliance.

What’s The Purpose of an Audit Compliance Report for Retail Store?

The purpose of an audit compliance report for a retail store includes regulatory compliance, financial accuracy, inventory control, operational efficiency, internal control review, risk mitigation, and stakeholder assurance.

- Regulatory Compliance: Ensures the retail store adheres to local laws (e.g., GST, labor laws, FSSAI if applicable) and avoids legal penalties.

- Financial Accuracy: Verifies the accuracy of financial statements, inventory records, and transaction logs to prevent fraud or misstatements.

- Inventory Control: Assesses how well inventory is tracked, stored, and managed, reducing losses from theft, shrinkage, or mismanagement.

- Operational Efficiency: Identifies gaps or inefficiencies in store operations, helping streamline workflows and improve performance.

- Internal Controls Review: Examines whether adequate internal controls are in place for cash handling, billing, discounts, and returns.

- Risk Mitigation: Highlights potential risks and provides recommendations to address them proactively.

- Stakeholder Assurance: Provides assurance to owners, investors, and regulatory bodies that the store is operating responsibly and transparently.

In short, the audit compliance report supports better decision-making, fosters accountability, and strengthens overall store governance.

What are The Key Components of an Audit Compliance Report?

The key components of an audit compliance report are merchandising audit, inventory audit, employee performance audit, and regulatory compliance audit.

Merchandising Audit

Merchandising audit checklist included checking if product displays follow planograms (pre-designed layout guides), confirming correct pricing tags, assessing promotional signage, and evaluating shelf organization. Proper merchandising enhances the customer experience, increases product visibility, supports brand consistency, and directly impacts sales.

Inventory Audit

This component of the audit report matches physical stock with system records, inspects storage conditions, identifies overstock or out-of-stock items, and tracks shrinkage due to theft or damage. Accurate inventory records, maintained using inventory management software, prevent loss, ensure product availability, and improve supply chain decisions, which is crucial for profitability.

Employee Performance Audit

This audit report section reviews attendance logs, evaluates individual sales performance, monitors adherence to customer service protocols, and observes behavior during peak hours.

It helps recognize high performers, identify training needs, assess the effectiveness of implementing incentive programs to boost employee performance, and maintain consistent service quality, contributing to customer satisfaction and retention.

Regulatory Compliance Audit

This component of the audit report verifies timely GST payments, checks employee wage compliance, confirms active licenses (e.g., FSSAI for food), and assesses adherence to safety standards. Ensuring retail compliance helps avoid legal issues, fines, and reputational damage while ensuring safe and ethical operations.

Each component plays a vital role in maintaining overall store efficiency, minimizing risks, and supporting sustainable retail operations.

How to Prepare an Audit Compliance Report for Retail?

To prepare an audit compliance report for retail stores, one must follow a series of seven steps.

- Define Audit Scope and Objectives: This step involves identifying the key areas to be audited: merchandising, inventory, employee performance, and regulatory compliance.

- Gather Documentation: In this step, one needs to collect sales reports, inventory logs, staff performance records, licenses, tax filings, and standard operating procedures (SOPs).

- Conduct Field Inspections: The next step is to visit the retail outlet to verify on-ground operations, merchandising displays, stock levels, and staff practices.

- Evaluate Each Audit Area: The fourth step involves evaluating each area for which the audit process is required.

- Merchandising: Check planogram compliance, price tags, and promotional displays.

- Inventory: Match physical stock with system data; identify shrinkage or overstock.

- Employee Performance: Review attendance, sales data, and customer service quality.

- Regulatory Compliance: Confirm GST filings, labor law adherence, and active licenses.

- Merchandising: Check planogram compliance, price tags, and promotional displays.

- Document Findings: Then, the observations are recorded, discrepancies are noted, and risk levels are assessed.

- Recommend Corrective Actions: Suggest solutions for each issue identified, along with timelines and responsible personnel.

- Compile the Report: Structure the findings clearly, with an executive summary, detailed observations, and action points.

Preparing an audit compliance report for a retail store involves a structured process. A well-prepared report helps improve compliance, efficiency, and business performance.

What Software Can Be Used for Audit Compliance Report?

Taqtics is the software that can be used for an audit compliance report, given the features it has to offer.

- Automated Audit Scheduling and Reporting: Taqtics allows for creating, scheduling, and automating store audits. Auditors can capture observations, photos, and videos via mobile devices, generating instant audit reports in formats like Excel, PDF, and PPT.

- Real-Time Notifications and Escalations: The platform provides real-time alerts and escalations, ensuring timely task completion and prompt issue resolution without constant oversight.

- Geo-Fencing and Compliance Tracking: Taqtics utilizes geo-fencing to ensure audits are conducted at designated store locations, enhancing compliance and accountability.

- Photo-Validated Evidence: The software captures photo evidence with timestamps, validating task completion and ensuring data integrity.

- Centralized Data Repository: All audit data is stored in a centralized location, easily accessible for analysis and reporting, eliminating the need for manual data retrieval.

By integrating Taqtics into your audit process, you can reduce manual efforts, enhance compliance, and make data-driven decisions that improve store performance.

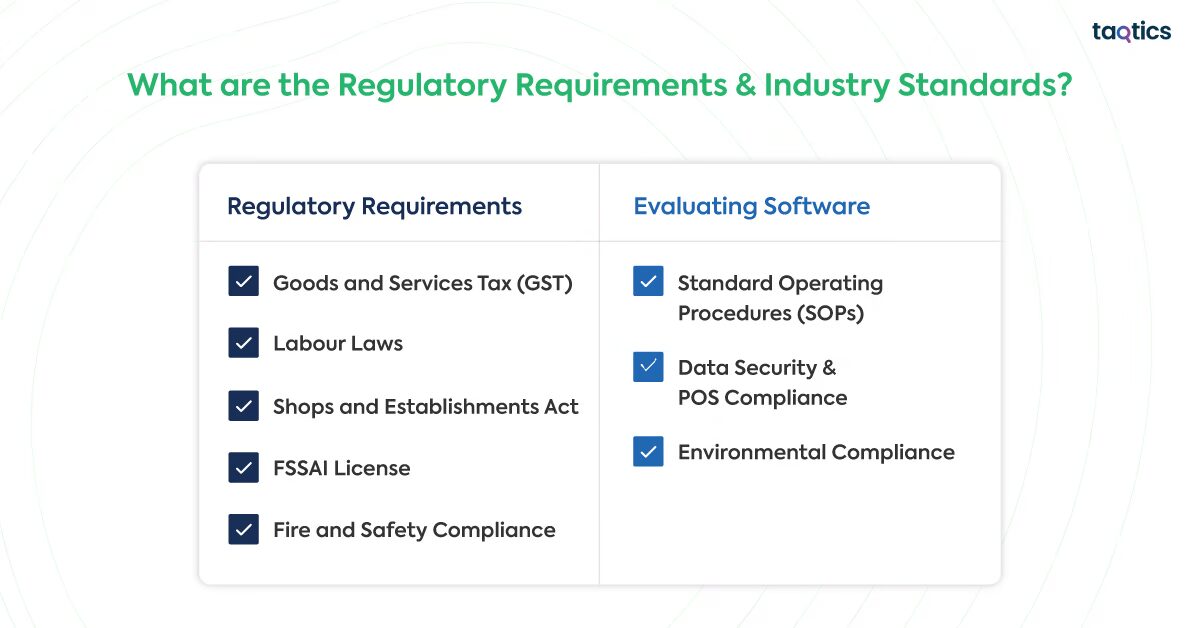

What are the Regulatory Requirements & Industry Standards?

The regulatory requirements and industry standards for retail stores in India form the foundation of an effective audit compliance report.

Regulatory Requirements

- Goods and Services Tax (GST): Accurate GST registration, invoicing, and timely filing of returns are mandatory.

- Labour Laws: Compliance with minimum wage laws, employee working hours, Provident Fund (PF), and Employee State Insurance (ESI) is essential.

- Shops and Establishments Act: Governs store operation hours, employee rights, and record-keeping.

- FSSAI License (for food retailers): This is mandatory for stores selling consumables, ensuring food safety and hygiene standards.

- Fire and Safety Compliance: Stores must have valid fire safety certificates and emergency preparedness.

Industry Standards

- Standard Operating Procedures (SOPs): Following SOPs in inventory management, merchandising, and customer service.

- Data Security & POS Compliance: Adherence to digital payment norms and protection of customer data.

- Environmental Compliance: Proper disposal of waste and eco-friendly practices in line with sustainability norms.

These regulations and standards guide the audit process, ensuring that the retail store operates lawfully, efficiently, and ethically while minimizing risks and enhancing customer trust.

What are The Common Challenges in Audit Compliance Reporting?

The common challenges in audit compliance reporting are manual data collection, lack of standardization, inaccurate inventory records, limited visibility across stores, staff unawareness or non-cooperation, delayed corrective actions, and regulatory complexities.

- Manual Data Collection: Reliance on spreadsheets and paper-based checklists can lead to errors, missed data, and time-consuming processes.

- Lack of Standardization: Inconsistent audit formats and criteria across locations make comparing results or tracking compliance trends difficult.

- Inaccurate Inventory Records: Mismatches between physical stock and system data due to theft, damage, or mismanagement can affect audit accuracy.

- Limited Visibility Across Stores: Multi-location retailers struggle with real-time tracking and oversight, making it hard to ensure uniform compliance.

- Staff Unawareness or Non-Cooperation: Employees may not be adequately trained in compliance standards, leading to unintentional violations during audits.

- Delayed Corrective Actions: Without a proper follow-up system, issues identified in audits may not be resolved promptly.

- Regulatory Complexity: Navigating multiple regulations like GST, labor laws, FSSAI, and local licenses can be overwhelming without expert support.

Addressing these challenges requires adopting standardized processes, digital audit tools, and continuous staff training to ensure smooth, efficient, and accurate audit compliance reporting.